Of great concern is the growth in the supply of "mixes" to the countries of Central Asia - the traditional Kazakhstan markets. For example, growth in exports to Uzbekistan tripled m/m. You also need to pay attention to the import of such products to Kazakhstan (in red).

This situation was not slow to affect the Kazakh market. Sunflower oil production dropped sharply in MY 2021-22:

Dynamics of production of sunflower (unrefined) oil with accumulation, thousand tons

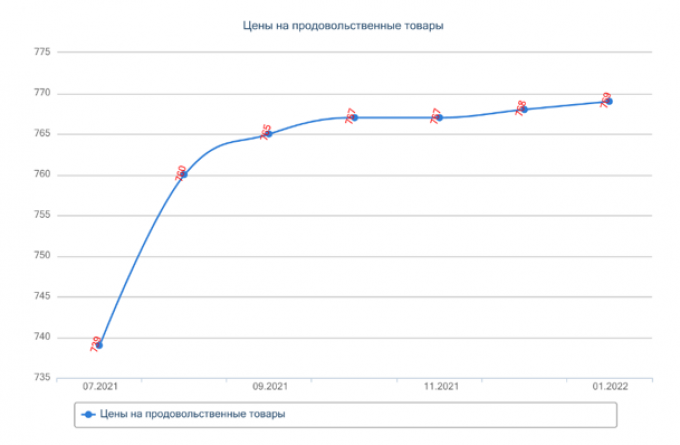

According to the National Statistical Service, the price of a liter of sunflower oil in the republic in August-January had a slight increase (+9 tenge):

In the regional context, the historically established disproportion was preserved: oil is cheaper in the east and north of the country, a little more expensive in the south and in the center, the leaders are the west and both capitals.

At the same time, the price of a ton of sunflower seeds, having reached 250 tenge/kg (free elevator) in mid-November, began to weaken sharply, and at present (beginning of February) the average transaction prices are within 220 tenge/kg (northern regions) and 170 tenge /kg (EKR, Pavlodar).

The main reason is the unequal competition of domestic oil refineries with Russian ones.

As you know, the Russian Federation has export duties on sunflower oil (January figure - $280/ton). However, suppliers from the Russian Federation have found a way to bypass them. Oil for delivery is declared as "Other non-volatile vegetable oils, liquid, mixed", TN VED code 1517909100, which is not mentioned in the restrictions regulation. This gives some Russian suppliers a significant advantage over their counterparts in Russia itself, and even more - over their Kazakhstani competitors, because even after paying an increased railway tariff (80 USD / MT), the profit from the “saved” duty is 200 USD / MT .

This is confirmed by customs statistics:

Export of oils from the Russian Federation under the TN VED code 151790 (main directions), thousand tons

Exports also show a significant gap from last season: Dynamics of exports of sunflower (unrefined) oil, thousand tons

And all this against the background of the fact that, according to the National Statistics, the gross harvest of sunflower was 1031 thousand tons, which is an absolute record for Kazakhstan. In other words, there is enough raw material inside the country to make butter production and exports at least close to last year. Instead, they decline.

It should be noted that for two consecutive months, the actual export of oil is half of the assigned quotas.

A comment:

As experts, including the author of these lines, repeatedly warned, sunflower quotas played the role of a deterrent for the entire market. For two months, the market was simply in limbo due to bureaucratic delays. At this time, Russian competitors have oriented themselves in their situation and ousted Kazakh exporters from their traditional markets.

In the current situation, it is pointless to do anything. For Russian officials, a “leakage” of 25,000 tons past duties against the backdrop of more than 200,000 exports is a trifle, they will not make changes to documents that were accepted with great difficulty (especially since gray dealers did a good deed across the country - opened new markets, increased the export component). For Kazakh exporters - these 25 thousand tons - in fact, the entire export. Today, at the beginning of February, Uzbek importers are probably contracted with “mixes” for the next two months. That is, until April we will have sluggish exports. It is unlikely that he will recover later.

Most importantly, in the conditions of complicated access to foreign markets, processors will look for marginality in the domestic market: retail oil will not get cheaper!